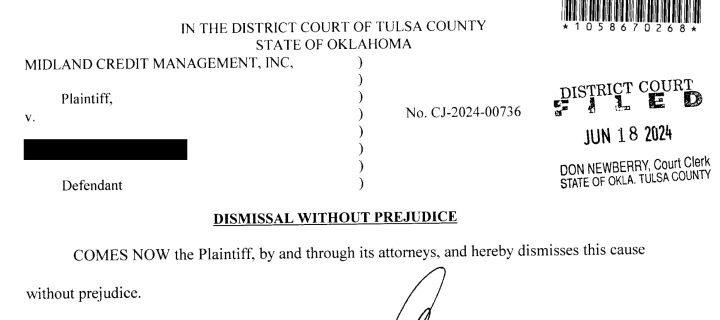

$12,000 Midland Credit Management Lawsuit Dismissed

From Motion for Default to Case Dismissed in 18 Days.

Recently, a client was served with a $12,000 lawsuit from Midland Credit Management (MCM). Confused and unsure of what to do, she decided to call Paramount Law in Tulsa, Oklahoma. Our team immediately got to work on her case. Less than 30 days later, Midland Credit Management dismissed the lawsuit, preventing a judgment against her.

Who is Midland Credit Management?

Midland Credit Management (MCM) is one of the largest debt buyers and collectors in the U.S. They purchase delinquent debts from various creditors for a fraction of their original value and then try to collect the full amount from consumers. Unfortunately, MCM is known for using aggressive and often deceptive collection practices.

How to Respond to a Midland Credit Management Lawsuit

If you’ve been sued by Midland Credit Management, it’s important to act quickly. Here are some steps to take:

- Read the Lawsuit Papers Carefully: Understand the details of the lawsuit.

- Respond to the Lawsuit: File a written response with the court to avoid a default judgment.

- Gather Evidence: Collect all documents related to the debt.

- Seek Legal Help: Contact a law firm like Paramount Law in Tulsa to help you defend your rights.

Defend a Midland Credit Management Lawsuit

Defending against a Midland Credit Management lawsuit can be challenging but not impossible. Here’s why you should fight back:

- Question the Debt’s Validity: Often, MCM cannot prove they own the debt or that the amount is accurate.

- Challenge Unfair Practices: MCM has a history of unfair and deceptive practices, which can be contested in court.

CFPB Enforcement Actions Against Midland Credit Management

The Consumer Financial Protection Bureau (CFPB) has taken multiple enforcement actions against MCM:

- 2015 Consent Order: MCM was found violating several consumer protection laws. The CFPB required them to make significant changes to their collection practices, including better documentation and disclosure (Consumer Financial Protection Bureau).

- 2020 Enforcement Action: The CFPB sued MCM for violating the 2015 consent order. They were accused of continuing to sue consumers without the necessary documentation and collecting on debts past the statute of limitations without proper disclosures (Consumer Financial Protection Bureau) (Consumer Financial Protection Bureau).

- Massachusetts Settlement: In 2022, MCM reached a $12 million settlement with the Massachusetts Attorney General for collecting debts without sufficient proof and using deceptive practices (Attorney General of Massachusetts).

What Do These Enforcement Actions Mean for You?

These enforcement actions show that MCM often struggles to prove ownership and validity of the debts they sue for. This means you have a strong defense if they can’t provide the necessary documentation. The CFPB’s actions demonstrate that MCM’s practices can be effectively challenged in court.

Call to Action: Contact Paramount Law in Tulsa

If you’ve been sued by Midland Credit Management, don’t fight it alone. Paramount Law in Tulsa, Oklahoma, can help. Our experienced team has a proven track record of defending clients against MCM and getting lawsuits dismissed. Although our past results should not create an unreasonable expectation of results in your case, as all cases have different facts, we’ve defended literally hundreds of Midland lawsuits, helping hundreds of Oklahoma consumers. Contact us today to discuss your case and explore your defense options. Let us help you achieve a favorable outcome with Midland Credit Management.

Ignoring a lawsuit from Midland Credit Management can lead to a default judgment against you. Take action now to defend your rights and protect your financial future. Reach out to Paramount Law in Tulsa for a free consultation and let us guide you through the legal process.

Stay informed and seek professional legal assistance to effectively respond to a Midland Credit Management lawsuit. Contact Paramount Law today and take the first step towards a successful defense.