Tulsa Debt Lawsuit Crushed: Velocity Investments Surrenders in 27 Days

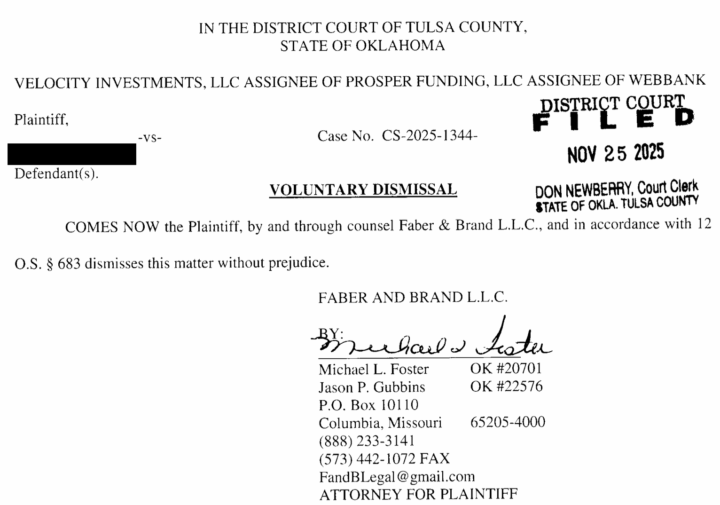

In the high-stakes world of debt collection defense and consumer rights law, swift victories are rare—but they’re exactly what our clients deserve. We’re thrilled to share a recent success story from our firm: securing a full dismissal of a lawsuit filed by Velocity Investments, LLC against one of our clients in Tulsa County, Oklahoma. The alleged debt? A $7,976.88 balance stemming from a Prosper Funding loan originally issued by WebBank. What makes this outcome even more remarkable? The case was resolved in less than one month after our involvement, with our client barely lifting a finger beyond that initial call to our office.

Understanding the Case: A Classic Debt Buyer Lawsuit

Our client was hit with a summons for an old personal loan debt that had been charged off and sold to Velocity Investments, a prolific debt buyer. Prosper Funding, a popular platform for unsecured personal loans, had originated the loan through WebBank, a Utah-based industrial bank known for partnering with fintech lenders. Once the account went delinquent, it was assigned to Velocity for aggressive collection efforts—including filing suit in Tulsa County District Court.

These types of debt buyer lawsuits are all too common in Oklahoma and nationwide. Debt buyers like Velocity purchase portfolios of defaulted accounts for pennies on the dollar, then pursue the full face value through litigation. For consumers, this can mean wage garnishment, bank levies, or long-term credit damage if not addressed promptly. Our client’s case was no exception: the suit sought the full $7,976.88 plus fees, interest, and court costs.

But here’s where experience matters. Upon reviewing the file, our team identified procedural weaknesses in the plaintiff’s claims—issues with chain-of-assignment documentation, validation lapses, and potential Fair Debt Collection Practices Act (FDCPA) violations. We prepared a robust response, demanding strict proof of the debt’s ownership and compliance with federal and state laws. Velocity’s counsel quickly recognized the risks and moved to dismiss the entire action without prejudice, sparing our client any further stress or expense.

This rapid resolution underscores the power of proactive debt defense strategies. Our client simply called our office, provided basic details, and let us handle the rest—from drafting defenses to negotiating behind the scenes. No endless paperwork, no court appearances, no out-of-pocket costs beyond our flat-fee consultation.

Who Is Velocity Investments, and What Do They Do?

Velocity Investments, LLC is a major player in the debt buying industry, headquartered in Wall Township, New Jersey. Founded in 2003, the company specializes in acquiring delinquent consumer debts—such as credit cards, personal loans, medical bills, and auto loans—from original creditors or other debt buyers at deeply discounted rates (often 2-5 cents on the dollar). They then attempt to collect the full amount owed, either through in-house efforts, third-party agencies, or legal action.

According to the Consumer Financial Protection Bureau (CFPB), Velocity qualifies as a debt collector and primarily operates as a debt buyer, purchasing large portfolios of “distressed receivables” to convert into cash. Their model extends the “borrowing experience” into collections by offering self-service payment portals, but critics note their aggressive tactics, including frequent lawsuits. Velocity partners with a network of law firms nationwide to enforce claims, making them a frequent adversary in Oklahoma debt collection lawsuits and beyond.

While legitimate, Velocity has faced scrutiny. The CFPB’s Consumer Complaint Database logs over 800 complaints related to “Velocity Portfolio Group” (an affiliated entity), citing issues like failure to validate debts, harassment, and improper collection notices. The Better Business Bureau rates them poorly (1/5 stars) based on more than 140 recent complaints about unresponsive service and validation disputes. Additionally, Velocity has been named in multiple class action lawsuits alleging FDCPA violations, such as unlawful threats of litigation and inadequate dispute notices.

Meet Faber & Brand, LLC: Velocity’s Legal Muscle in This Case

Representing Velocity in the Tulsa County suit was Faber & Brand, LLC, a multi-state debt collection law firm with a focus on creditor rights and asset recovery. Established in 1998, the firm is based in Columbia, Missouri, and is licensed to practice in several states, including Oklahoma, Missouri, Illinois, Arkansas, and others. Faber & Brand specializes in pre-litigation demands, filing collection suits, judgment enforcement, and subrogation claims across six key asset classes: consumer finance, healthcare, utilities, retail, auto, and education loans. They often handle high-volume caseloads for debt buyers like Velocity, but in our client’s matter, their position proved untenable against our defenses. This dismissal highlights how even seasoned firms like Faber & Brand must back down when faced with airtight consumer debt defenses.

Why This Matters for Oklahoma Families Facing Debt Collection

Stories like this one are a beacon for anyone in Tulsa or across Oklahoma dealing with Prosper loan collections, WebBank assignments, or aggressive debt buyers. The FDCPA and Oklahoma’s consumer protection laws level the playing field, but only if you act fast. Ignoring a summons can lead to default judgments with devastating consequences—garnished wages (up to 25% in OK), frozen accounts, and credit scores tanked for seven years.

Our firm has a track record of dismantling these cases through validation demands, statute of limitations challenges, and FDCPA counterclaims. If Velocity Investments or Faber & Brand has you in their sights, don’t wait. A single call can turn the tide.

Ready to Fight Your Debt Collection Lawsuit?

Whether it’s a debt buyer dismissal in Tulsa County or statewide defense against unfair practices, Paramount Law is here to protect your rights. Contact us today for a free case review—no obligation, just results.

Disclaimer: The results described in this post are specific to this particular case and do not guarantee similar outcomes in future matters. Past performance is not indicative of future results. Every case is unique, and success depends on individual circumstances. This information is for educational purposes only and does not constitute legal advice. Consult with an attorney for personalized guidance.