Head of Federal Consumer Protection Group to Step Down After Wall Street Pressue

CFPB Director Resignation

Richad Cordray has announced on Wednesday, November 15th 2017, that he will step down before the end of the month. This could potentially be bad news for consumers and require more work for Louisiana debt collection attorneys.

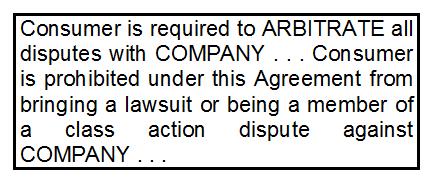

The current political climate has been favoring Wall Street and big banks. Recently, the U.S. Senate and Vice President Mike Pence have voted for consumers to be barred from fair trials against creditors and be forced into an arbitration court that almost always rule against consumers. Louisiana debt collection attorneys fear that Richard Cordray’s exit will further this political trend and leave the current administration with an opportunity to replace him with someone who does not have consumers’ best interest in mind.

Consumer Advocacy Progress under Richard Cordray

Richard Cordray’s tenure as director of the Consumer Financial Protection Bureau (CFPB) began six-years ago. His tenure trended with aggressive efforts to support consumers and protect them from financial predatory actions by Wall Street and big banks. The majority of Louisiana debt collection attorneys and consumer advocates supported his policies and efforts.

Background of CFPB and Louisiana Debt Collection Attorneys

The CFPB was formed in response to the 2008 financial crisis. Wall Street and big banks neglected long term plans for short term profits. Then, the banks required the government to give them hundreds of millions of dollars. Moreover, consumers were left with the bill and not able to pay it all. Due to this, Louisiana debt collection attorneys worked tirelessly to help prevent people from foreclosing and losing their homes.

A New Political Regime

The Current Climate in Consumer Advocacy and Louisiana Debt Collection Attorneys

With a new political regime in government, there has been increasing clashes with the CFPB director, Richard Corday. Consumer opponents who’s agenda aligned with Wall Street and big banks where frustrated that Cordray did not immediately step down with the previous presidential regime at the beginning of this year.

Recent appointments, with inherent plans to restructure the Federal Reserve, have included a former private equity investor, who is very likely to make things easier for the banking industry to increase profits and more difficult for consumers. Louisiana debt collection attorneys predict that this will likely make consumers more likely to be victims of predatory financial schemes. Further, consumers will likely need professional advocacy to not be taken advantage of by big banks as rolling back regulations leaves consumers more vulnerable.

Impacts on Louisiana Debt Collection Laws

It is not entirely clear what changes will be made to the CFPB with new leadership. Correspondingly, it is not clear what changes will be made to the Louisiana debt collection laws. However, consumer advocacy groups and Louisiana debt collection attorneys, such as at Paramount Law, will likely be increasingly necessary to prevent the victimization of hard working consumers from big banks and Wall Street.