FTC’s Operation Collection Protection Seeks Illegal Debt Collectors

FTC’s Operation Collection Protection Seeks Illegal Debt Collectors

Recently, there has been news exposing some schemes and alleged harassment by debt collection agencies against consumers. People are often contacting our office for information on how to beat debt collectors. Well, just last week, the FTC (Federal Trade Commission) together with other some other government authorities, made an immediate action to address the issue under the Operation Collection Protection initiative. Law enforcement authorities teamed up with the FTC for collaborative efforts targeting all abusive debt collection entities with regards to their manner of collecting debts. This combined task force is composed of Federal, State, as well as Local law enforcement offices, which aim at abolishing any and all unlawful debt collection acts, under the FDCPA (Fair Debt Collection Practices Act) that includes prohibitions against harassing phone calls, arrest threats, and many other tactics.

Recently, there has been news exposing some schemes and alleged harassment by debt collection agencies against consumers. People are often contacting our office for information on how to beat debt collectors. Well, just last week, the FTC (Federal Trade Commission) together with other some other government authorities, made an immediate action to address the issue under the Operation Collection Protection initiative. Law enforcement authorities teamed up with the FTC for collaborative efforts targeting all abusive debt collection entities with regards to their manner of collecting debts. This combined task force is composed of Federal, State, as well as Local law enforcement offices, which aim at abolishing any and all unlawful debt collection acts, under the FDCPA (Fair Debt Collection Practices Act) that includes prohibitions against harassing phone calls, arrest threats, and many other tactics.

As of the moment, the Operation Collection Protection by the FTC has recorded around a hundred and fifteen numbers of unlawful debt collection practices as well as hooked up with about seventy law enforcement agencies. One of the most common cases reported was the so-called collection of “phantom debts”. This is a type of debt accounted for a consumer by the consumer him/herself did not really owe such debt. Another unlawful action that the authorities want to target is alleged harassing debt collection without giving proper notices, disclosures, and other legal licensing documents to consumers.

The FTC has identified 5 debt collection institutions, which allegedly practice unlawful debt collection under the FDCPA. These institutions include Bam Financial, Delaware Solutions, K.I.P., LLC, and National Check Registry. The commission made an appeal to the federal courts to give emphasis on 3 improper debt collection practices.

The FTC FDCPA action against Bam Financial

According to the FTC, this debt collection agency has been able to force its consumers to pay for their debts through deception, threats, and other debt collection methods which violate the FDCPA. The Commission reveals that his institution used lawsuit threats, arrest, and wage garnishment. The FTC further elaborates that Bam Financial was able to make their unlawful scheme possible by impersonating lawyers and customer service representatives. Bam Financial also unlawfully revealed consumers’ debts to third-party entities, harassed debtors, and failed to explain their identities as legitimate debt collection representatives. Furthermore, the company also did not abide by the existing rule that debtors must be given, in any case, their right to receive notice as well as the opportunity to verify any and all alleged debts they have prior to the time of collection.

There was even an instance when the defendants suddenly informed a mother that they have with them a warrant of arrest for her daughter. Moreover, they told the accused debtor that they would have a sheriff execute the said arrest. Another instance includes threatening a debtor that she will no longer be permitted to see her kids, her wages will be garnished, and that she will be reported to the IRS (Internal Revenue Service) if he won’t pay the amount the said he owed.

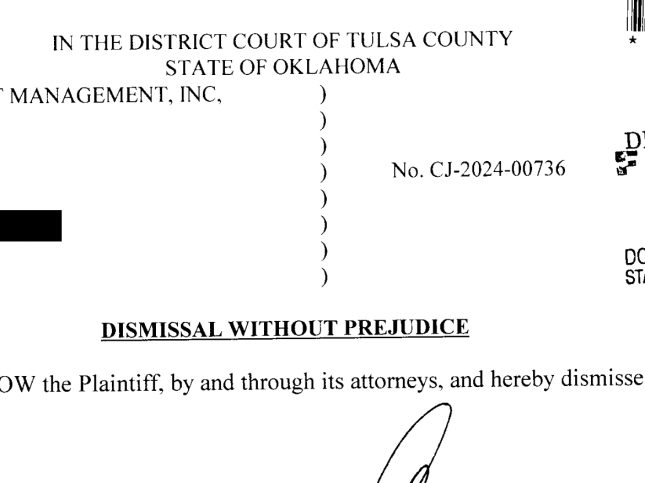

The court issued a TRO against the defendants from this institution on 21st day of October 2015. As of the moment, the operations of Bam Financial are currently halted.

The FTC FDCPA action against Delaware Solutions

New York State’s Attorney General together with the FTC filed charges against Delaware Solutions because of alleged collection of “bogus” (invalid or false) debts. The authorities exposed that this institution purchased payday loans which they say that a company owned. However, the Commission finds out that the company has been repeatedly telling them not to make any collections due to the fact that purported debts were not valid. Also, Delaware Solutions ignored documents from consumers proving that they’ve never had any authorized payday loans which the institution identified.

The lawsuit also explains that defendants from Delaware Solutions also did not identify themselves as legitimate debt collectors, impersonated attorneys and used false process servers, and harassed consumers with arrest and/or litigation threats. Another unlawful action that the defendants are accused is the disclosure of consumers’ owed accounts to a third party, attempting to embarrass the debtors and force them to make their payments. The law protects consumers from such illegal debt collection practices, regardless whether the debt is legitimate or not. This action resulted to a TRO (temporary restraining order), stopping the operations of Delaware Solutions.

Almost the same cases have been filed against the K.I.P., LLC, and the National Check Registry, only that K.I.P., LLC has not been issued with a temporary restraining order from the court. Instead, the proposed final order restricts the accused to have any misinterpretations on any of their financial products and/or services. They were also prohibited to make profits from the personal data of their consumers as well as mandated to utilize any of such data in the most proper and lawful manner. The said final order also requires more than $6.4 million judgment, which incorporates car sale proceeds and assets turnover under the custody of third-party entities. The FTC is still waiting for the court approval of the proposed final order stipulation, which obtained a 4-0 vote.

In the final court order released by the United States District Court for New York’s Western District, K.I.P., LLC, and National Check Registry were mandated to pay a million dollars (in judgment), close monitoring, and banned them from operating in this kind of business for life. As new settlements progresses, the FTC has been able to close a total of 7 cases. This has placed thirty-three offenders under strict court orders. In addition to, the Commission has also secured more than $88 million dollars in judgments and banned 24 proven-guilty defendants from involving in the debt collection industry for the rest of their lives.

In the middle of all these efforts to hunt all debt collection entities with unlawful operational practices, the Commission makes itself clear that the FTC along with the other law enforcement agencies only file charges when there are believable reasons to do such. Additionally, any complaint they file is based on the fact there was disobedience with the law and that each specifically aims to protect the interests of the general public.

Paramount Law Fights Illegal Debt Collectors under the FDCPA

While the FTC does enforce these types of actions in bulk, individual consumers also have the right to sue illegal debt collectors under the FDCPA. According to federal law, consumers who have been victims of debt collection harassment have the ability to retain an FDCPA lawyer like Paramount Law without paying anything out of pocket. If you feel like you are getting the run around by illegal debt collectors, call our office for a free consultation.