Leveraging the FCRA: How a Lawyer can Help Rectify Your Inaccurate Credit Report due to Identity Theft

Stolen identity messing up your score? Feel like you’ve lost control over your financial narrative due to inaccuracies in your credit report? It’s a common plight facing countless consumers who fall victim to identity theft. But there’s a solution, and it involves knowing your rights under the Fair Credit Reporting Act (FCRA) and getting a skilled consumer law firm like Paramount Law on your side to enforce those rights.

The journey back to financial health can seem daunting, especially when confronted with an inaccurate credit report. However, having a lawyer by your side who understands the nuances of the FCRA can make this journey significantly less challenging. The FCRA, a federal law designed to protect consumers, holds credit bureaus and debt collectors accountable for maintaining accurate consumer credit information. When they fail to do so, consumers have legal recourse.

When your identity has been stolen, and you are left with an inaccurate credit report, it is crucial to act swiftly. Many are unaware that they can engage a lawyer to navigate this complex situation on their behalf. Paramount Law is well-versed in the FCRA and are adept at compelling credit bureaus and collectors to correct errors arising from identity theft on your report. What’s even more impressive is that our services come at no cost to you; the law stipulates that the guilty parties – the credit companies that messed up your reports – must foot the bill.

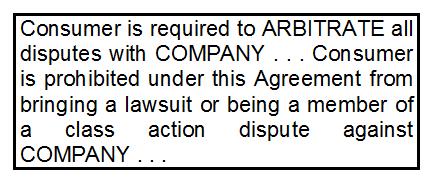

Having an attorney familiar with the FCRA on your side is a significant advantage. They will guide you through the process of disputing inaccuracies in your credit report due to identity theft. This often involves writing a formal dispute letter to the credit bureaus, outlining the inaccurate information, and providing supporting evidence of the identity theft. If the credit bureaus don’t correct the inaccurate information, we can file a lawsuit on your behalf, holding the bureaus accountable for violating the FCRA.

Importantly, the FCRA empowers consumers to seek damages for any harm they have suffered due to the credit bureaus or collectors’ negligence. These damages can include emotional distress, loss of credit opportunities, and, in some cases, punitive damages meant to punish particularly egregious behavior. We will help you demonstrate the harm caused and help you receive the compensation you deserve.

Dealing with an inaccurate credit report due to identity theft is undoubtedly stressful. However, you’re not alone in this process. We can help you regain control of your financial narrative by ensuring that your credit report accurately reflects your credit history, free from the errors introduced by the identity theft.

Remember, you have the right to a correct credit report, and the FCRA is a potent tool to ensure that this right is upheld. So, don’t wait. Call us today and take the first step in taking back control of your financial future.