New Payday Loan Restrictions: Will You Be Affected?

Federal and Louisiana Debt Collection Laws Update:

Federal Regulators Put Payday Loans Lenders in Short Lease with New Rules. New Orleans Debt Lawyer Takes Note

On Oct 5, 2017, Federal Regulators issued new rules that will affect Louisiana debt collection laws. These new rules will not only limit access to payday loans for consumers, but also restrict the payday loan providers’ ability to take advantage of the consumers for so long.

Payday Loans Background

Payday loans allow people in need of quick cash to get it without long form filling and approval waits. In exchange for this easier access to loans, payday loans providers charge high interest rates with a very short repayment schedule. Due to this, borrowers are often unable to pay them back and end up taking out more loans to pay them off. This leads to the borrow falling into a perpetual cycle of debt that they cannot come out of.

Updates and Effects of New Rules on Louisiana Debt Collection Laws

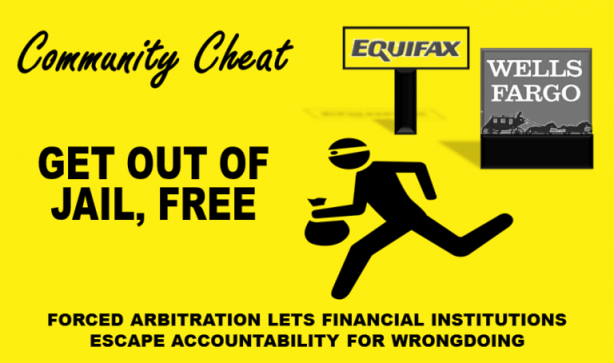

Part of the new payday restrictions grant more authority to the Consumer Financial Protection Bureau (CFPB). The CFPB will then require payday loan providers to first determine the repayment capacity of the borrower. This determination will also consider how the borrower will still have the ability to pay for all of their basic and major expenses. This is an effort by the CFPB to prevent the victimization of borrowers from loan deception and predatory practices. A New Orleans debt lawyer advises against these practices and can determine if they are violations of the FDCPA and Louisiana debt collection laws.

Additionally, Louisiana debt collection laws will prohibit payday lenders from issuing three loans consecutively without a grace period to the same borrower. Also, the payday lenders will not be allowed to make more than two failed payment collection attempts without consent of the borrower. A Louisiana consumer attorney could assist in determining if the payday lender’s actions may be in violation of this restriction.

Payday Pitfall Still Remains

Payday lenders, however, can still issue loans up to $500 without any consideration of the borrower’s ability to repay. However, they need to provide a more extended repayment schedule. Banks and credit unions can continue to offer personal loans to consumers. New Orleans debt lawyers and Louisiana consumer attorneys generally are in agreement of the new rules as it would help stop the debt traps that people often find themselves in after taking payday loans that Louisiana debt collection laws have previously not prevented. Yet, there will still be risks in dealing with payday loans agencies.

As a New Orleans debt lawyer or Louisiana consumer attorney may provide, the new rules and Louisiana debt collection laws will help prevent borrowers and their families from being trapped in the vicious cycle of debt and restrict people from borrowing when they are not in a position to repay it. The new rules have been in the pipeline for many years, and many felt that changes in Louisiana debt collection laws have been long overdue for reform.

Future of Payday Loans on Consumers

While the new rules will not completely prevent the vicious cycle of lenders putting borrowers into spiraling debt, they are a step in the right direction against the predatory scheme of payday loans. If you are currently experiencing exceeding debts or debt collection harassment, contact a Louisiana consumer attorney or New Orleans debt lawyer that specializes in Louisiana debt collection laws at Paramount Law today. They can determine your best options to avoid becoming another victim of the deception from a payday loan agency.