Warning: The “Wrong Number” Text Scam Exploding Across the Nation Right Now

Wrong number text message?

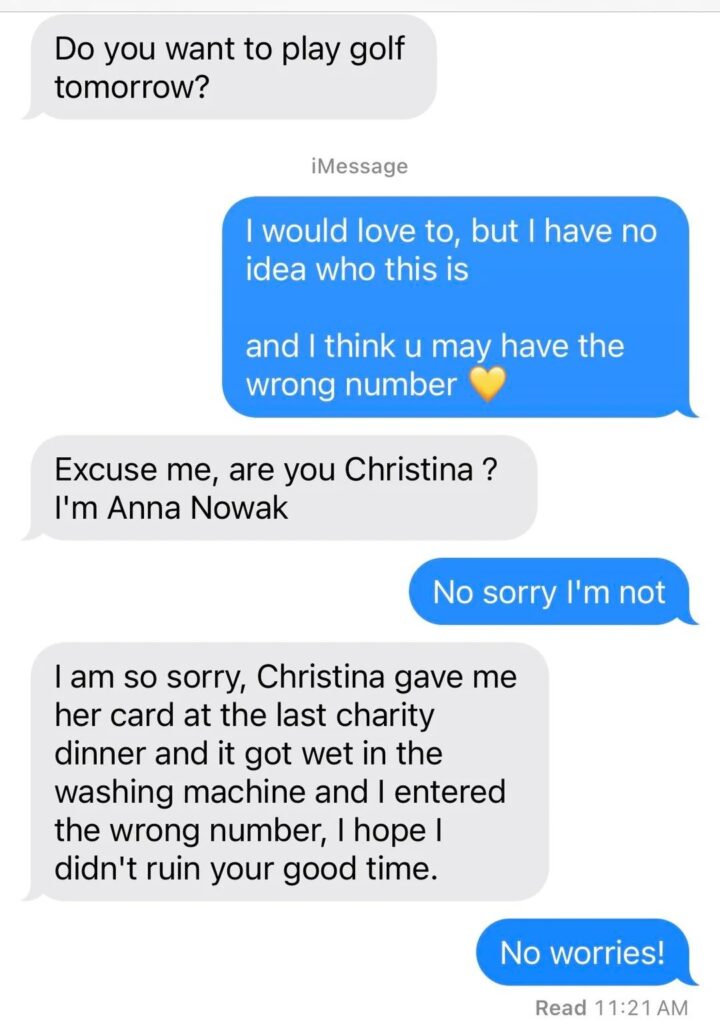

Your phone buzzes. Unknown number. The message reads:

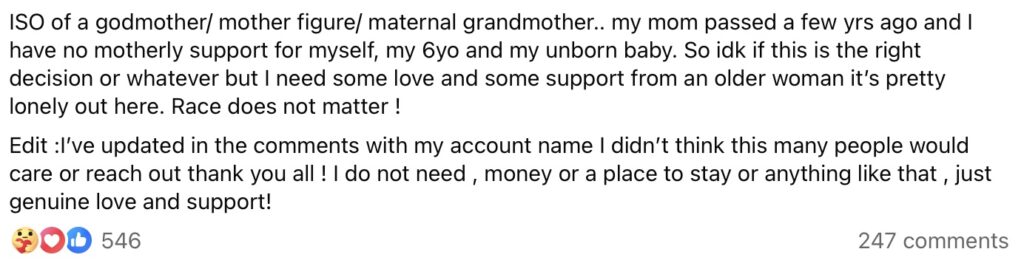

“Hey!! Fishing or horseback riding tomorrow? 😄” or “I just tried calling – are you still coming to the party Saturday?” or the gut-punch version: “Hi… this is the number Mom gave me before she passed. She said you were like a mother to her friends. I could really use someone to talk to.”

You think it’s a simple wrong number. You’re a decent person, so you reply “Sorry, wrong number” or “I think you have the wrong person.”

That one polite reply is exactly what the scammer wanted.

Welcome to the newest wave of catfish / pig-butchering scams that are flooding the U.S. right now.

What is a Catfish or “Pig-Butchering” Scam?

“Pig-butchering” is the English translation of the Chinese term shā zhū pán (杀猪盘) – the scammer “fattens up” the victim with trust, affection, or friendship before slaughtering them financially. This terminology originated within Chinese online fraud communities around 2016, reflecting the scam’s mechanics of nurturing a victim’s financial trust before extracting funds, akin to agricultural practices of fattening livestock for eventual slaughter.

It can start romantic (“lonely U.S. soldier stationed overseas”) or completely platonic (“I just lost my mom and need a mother figure” – we’ve seen these exact posts on Tulsa-area Facebook groups). The goal is the same: build an emotional bond over days or weeks, then introduce a “once-in-a-lifetime” investment (almost always fake crypto platforms). Victims are walked step-by-step through sending larger and larger sums until retirement accounts, home equity lines, and life savings are gone.

Real Oklahoma-Area Losses (2024–2025 cases we know about)

These aren’t just hypotheticals—Oklahoma is a hotbed for these scams, ranking high in per-victim losses nationwide. Here are documented examples from 2024–2025:

- In a devastating Tulsa case, a local couple lost over $5 million to a pig-butchering scam. The husband was lured into fake cryptocurrency investments after being groomed by scammers, highlighting the role of banks in failing to flag suspicious transfers.Read the full WSJ story at MSN.

- An Oklahoma woman was accused of laundering $1.5 million from elderly victims in online romance scams, posing as wealthy suitors to extract funds which were funneled through Oklahoma banks.Details from People.com.

- Statewide trends show Oklahomans lost nearly $67 million to online scams in the previous year, with romance and investment frauds (including pig-butchering) leading the pack, often facilitated by AI and social media. Fox 25 scam trends overview.

- Earlier data from 2021 reported $52 million in losses to online scams in Oklahoma, with a sharp rise in romance, cryptocurrency, and investment frauds affecting all ages, especially seniors and young adults.Broader context from Journal Record.

- These aren’t gullible teenagers. These are smart, kind, normal Oklahomans who simply responded to a text. Nationally, romance scams alone cost victims over $800 million in 2024, with pig-butchering variants exploding in sophistication.

These aren’t gullible teenagers. These are smart, kind, normal Oklahomans who simply responded to a text.

Red Flags of the “Wrong-Number” Opener

- The message assumes familiarity (“Are we still on for tomorrow?”)

- It contains an emotional hook or fun activity to make you want to respond

- The area code may be local (spoofed) or from anywhere

- If you do reply, the next message is always friendly, apologetic, and designed to keep the conversation going

The Only Safe Response: NONE

Do not say “wrong number.” Do not say “who is this.” Do not engage at all.

Block the number → Report as Junk → Move on.

One reply tells the scammer your number is live and that you’re polite enough to answer unknown texts. You instantly get moved to the “high-value target” list and the real grooming begins.

If You’ve Already Lost Money — Can We Help?

We have to be completely honest with you: In the vast majority of pig-butchering/catfish cases, the answer is NO — because you personally authorized every transfer. If you logged into your banking app, typed in the amount, hit “send,” or handed over your debit card info because the scammer convinced you it was a “safe investment,” the law treats those as voluntary, authorized transactions. Banks almost never reverse them, and neither can we.

BUT — there ARE limited situations where we CAN fight for you under the Electronic Fund Transfer Act (EFTA / Regulation E).

When someone calls our office after falling for one of these scams, these are literally the first two questions we ask:

- “Did someone take money out of your bank account without your permission — and now the bank refuses to put it back?” (Example: A scammer somehow got your routing/account number and pulled money via ACH or debit card without you ever approving it.)

- “Did you notify your bank in writing within 2 business days after you learned of the unauthorized transfer?”Your maximum liability under EFTA: • Within 2 business days → $50 max loss • Within 60 calendar days → $500 max loss • After 61+ days → You can lose everything (unlimited liability)

If the answer to Question 1 is YES (truly unauthorized) and you disputed it fast enough, we have a real shot at forcing the bank to refund every penny under the EFTA — even if a scammer was ultimately behind it.

If the answer to Question 1 is NO (you authorized the transfers yourself because you were tricked), recovery is unfortunately almost impossible, no matter how convincing the lie was.

What Is an EFTA Unauthorized Transfer Claim?

Under the Electronic Fund Transfer Act (15 U.S.C. § 1693) and Regulation E (12 CFR Part 1005), banks MUST refund unauthorized electronic fund transfers including:

- Unauthorized ACH withdrawals

- Unauthorized debit card charges

- Unauthorized “check-by-phone” or remotely created checks

- Any electronic transfer initiated without your actual authority

Maximum consumer liability (if you report on time):

| When You Notify Bank | Maximum You Lose |

|---|---|

| Within 2 business days | $50 |

| Within 60 calendar days | $500 |

| After 60 days | Unlimited — bank can refuse refund |

EFTA Does NOT Cover (Common Misconceptions)

- Wire transfers (governed by UCC Article 4A)

- Zelle, Venmo, Cash App, Apple Pay (treated as authorized once you press send)

- Cryptocurrency transfers

- Transfers you personally authorized because you were tricked (pig-butchering “investments”)

If money was taken electronically without your real permission and your bank is refusing the refund, call us immediately — the 60-day EFTA clock is ticking.

Free case review for any potential EFTA unauthorized electronic fund transfer claim.

📞 Call or text (918) 200-9272 today — the sooner you act, the more we can recover.

Disclaimer: This post is for informational purposes only and is not legal advice. If you’ve already sent money, contact law enforcement and notify your bank in writing immediately.