Why Hire an Attorney to Defend a Credit Card Debt Buyer Lawsuit?

Hiring an experienced consumer protection attorney to defend a credit card debt buyer lawsuit is crucial for several reasons.

First, credit card debt buyer lawsuits are becoming increasingly common. Companies such as Midland Credit Management, Portfolio Recovery Associates, LVNV Funding, Credit Corp Solutions, and Oliphant Financial purchase delinquent credit card debt from banks and other creditors and then attempt to collect on that debt through the courts. However, they often lack proper documentation or proof of ownership, which can make it difficult for consumers to defend themselves in court.

Second, an experienced consumer protection attorney like the lawyers at Paramount Law will have a deep understanding of the Fair Debt Collection Practices Act (FDCPA) and other consumer protection laws. These laws provide consumers with certain rights and protections when dealing with debt collectors, and an attorney will know how to use these laws to your advantage.

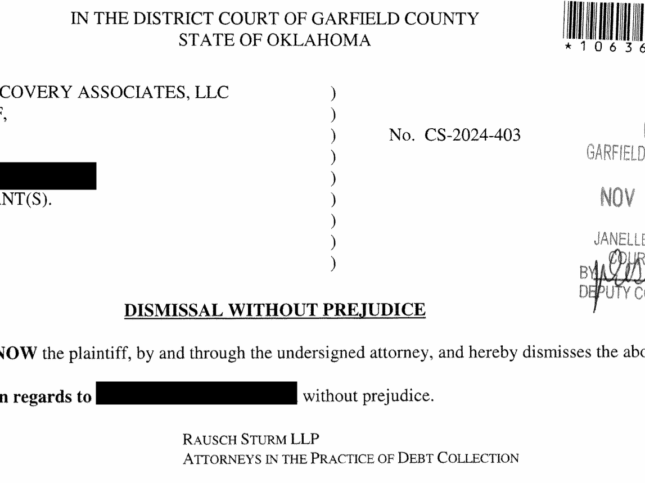

Third, an attorney can help you navigate the complex legal process and ensure that your rights are protected throughout the lawsuit, and are often able to obtain a dismissal of the lawsuit without paying the debt buyer. They can also negotiate with original creditors to reach a settlement that is in your best interests.

Fourth, a consumer protection attorney can help you to identify potential defenses, such as the statute of limitations, and challenge any attempts by the debt buyer to collect on a debt that is past the statute of limitations.

In conclusion, hiring an experienced consumer protection attorney to defend a credit card debt buyer lawsuit is essential to protecting your rights and ensuring that you are treated fairly in the legal system. An attorney can help you navigate the complex legal process, identify potential defenses, and negotiate a settlement that is in your best interests.