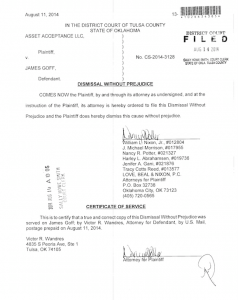

$3,000 Love Beal & Nixon Lawsuit Dismissed!!

Another $3,000 Asset Acceptance Lawsuit Dismissed by Love Beal and Nixon!

On May 19, 2014, Oklahoma City collection law firm, Love Beal and Nixon filed a credit card debt lawsuit in Tulsa, Oklahoma for its junk debt buyer client, Asset Acceptance Collection Agency. The lawsuit alleged that Asset Acceptance purchased old HSBC credit card debt, and claimed that our client owed nearly $3,000. 45 days after we were hired, the lawsuit was dismissed!

Having made numerous payments to HSBC for this card over the years, our client disputed that the amount of interest, charges, and fees as stated by Love Beal and Nixon in the lawsuit was even correct. Additionally, our client had never heard of the plaintiff who was suing him — Asset Acceptance. He called our firm after another attorney recommended an experienced Oklahoma law firm that specializes in credit card lawsuits and debt defense — Paramount Law.

According to the 2013 Annual investor report filed by Asset Acceptance LLC, (through its parent company, Encore Capital Group, Inc.), it was the Love Beal Nixon Law Firm that actually “[made] the decision about whether … to pursue collection litigation” for Asset Acceptance and chose to sue our client! However, when challenged by our firm regarding the legal standing of Asset Acceptance LLC to bring a lawsuit for a debt owed to HSBC, Love Beal Nixon Attorneys quickly dismissed the case without our client paying them anything. In this case, the lawsuit was dismissed just 45 days after we were hired!

Why is Asset Acceptance Suing Me?

It’s not just you, Asset Acceptance Collections files thousands and thousands of lawsuit against consumers every year. According to the 2013 Annual investor report, Asset Acceptance claims to generate a significant portion of its revenue by collecting on judgments that are granted by courts in Asset Acceptance lawsuits filed against consumers. “A decrease in the willingness of courts to grant these judgments, a change in the requirements for filing these cases or obtaining these judgments, or a decrease in our ability to collect on these judgments could have a material and adverse effect on our results of operations,” Asset claims on page 23. “As we increase our use of the legal channel for collections, our short-term margins may decrease as a result of an increase in upfront court costs and costs related to counter claims. We may not be able to collect on certain aged accounts because of applicable statutes of limitations and we may be subject to adverse effects of regulatory changes. Further, courts in certain jurisdictions require that a copy of the account statements or applications be attached to the pleadings in order to obtain a judgment against consumers. If we are unable to produce those account documents, these courts could deny our claims, and our results of operations and cash flows may be materially adversely affected.”

Amazingly, Asset Acceptance LLC actually states in a federal filing that its business operations might be adversely affected by those pesky courts that require them to actually carry the burden of proof and provide evidence that it has the right to sue on an account generated by a different creditor!

As the FTC has concluded in its 2013 report, “The Structure and Practices of the Debt Buying Industry,” the FTC found that the debt buyers obtained very few documents related to the debt they purchased. In fact, for most of the accounts, debt buyers didn’t receive any documents at the time they purchased the debts from the original creditor. Typically there were only a small percentage of accounts that included basic documents like account statements and the terms and conditions related to the account.

Somewhat humorously, Asset Acceptance blames “operat[ing] in an extremely litigious climate” in the very next paragraph as an excuse for possible adverse effects on its operations from lawsuit against it as it is subject to numerous consumer laws like the FDCPA that force them to pay out cash to consumers they have wronged.

Why do they dismiss so quickly?

Debt buyers like Asset Acceptance usually pay just a very small fraction of the original debt amount in order to “acquire” the right to sue you for the whole thing! In fact, according to Encore Capital Group’s (Asset Acceptance parent company) 2013 Annual Investor Report, if Asset bought your debt in 2013, it paid “an average purchase price of 1.4% of face value” (p.47). This means that for a $1,000 debt, Asset Acceptance paid about $14 bucks for the right to sue you! In Oklahoma, like most states, debt buyers are permitted to sue for the entire balance of the debt – no matter how little they paid for it.

Debt buyer law firms normally rely on statistics such as 9 out of 10 consumers won’t file an Answer to a lawsuit, allowing them to obtain a judgment and “win” the lawsuit in about a month after they file it with the Court, without having to actually prove their case or provide any documents to the judge! However, when you engage a debt defense law firm like Paramount Law after being sued, your odds dramatically increase that the lawsuit will be dismissed without you having to pay anything to the debt buyer or its law firm. We’ll force the debt buyer to “show their hand,” which usually will result in a complete dismissal of your case.

How much does it cost to hire an attorney?

Possibly nothing. When you contact our firm, our debt defense lawyers will thoroughly investigate Whether you could qualify for free legal representation due to any FDCPA violations. We’ve brought several federal lawsuits against Love Beal and Nixon and Asset Acceptance for violation of federal laws protecting consumers from unfair debt collection activities.

Asset Acceptance is no stranger to FDCPA violations. There are many Asset Acceptance complaints. In January 2012, Asset Acceptance entered into a consent decree with the FTC ending an FTC investigation into its compliance with the FTCA, FDCPA, and FCRA. As part of the consent decree, Asset Acceptance LLC agreed to undertake certain consumer protection practices, including, among other things, furnishing additional disclosures to consumers when collecting debt past the statute of limitations, and paid a civil penalty of $2,500,000!

If it appears that you have been the victim of unfair debt collection, our firm may be able to defend your lawsuit without charging you anything out of pocket. Even if there appears to not have been any unfair collection activity, our lawyers will be happy to give you a free telephone consultation regarding your lawsuit. Many of our clients are surprised at our extremely low rates and very high success rate of getting Love Beal and Nixon and Asset Acceptance lawsuits dismissed!

However, it is important for you to immediately call us upon learning of your lawsuit. We do not recommend that consumers attempt to “play lawyer,” and find some credit card defense pleadings on the web as we have seen many, many consumers lose to these companies. Call us for a free consult before doing this! A judgment, after it has been granted, is very difficult to have vacated, and could follow you for life, allowing a Love Beal Nixon Garnishment of your wages or bank account without further notice to you. Don’t wait! It’s important to call us at 918-200-9272 or fill out the webform on the TOP of this page as soon as you find out about any lawsuit brought by Love Beal and Nixon or Asset Acceptance!