In today’s digital age, receiving text messages from various sources, including debt collectors, has become common. These messages can be intrusive and stressful, especially if you’re dealing with financial difficulties. However, it’s important to know that you have rights when it comes to your privacy, and the Fair Debt Collection Practices Act (FDCPA) is here to protect you. This blog post will explain your rights under the FDCPA, particularly focusing on how you can stop unwanted text messages from debt collectors and what steps you can take if your rights are violated.

The FDCPA, or Fair Debt Collection Practices Act, was enacted in 1977 to eliminate abusive practices in the collection of consumer debts. The Act aims to promote fair debt collection and provide consumers with a way to dispute and validate debt information to ensure its accuracy. According to the FDCPA, its purposes include:

The FDCPA recognizes the importance of consumer privacy. It was designed to prevent harassment and ensure that debt collectors respect your rights. This is particularly relevant today, as technology has made it easier for debt collectors to contact consumers via text messages and emails. The FDCPA provides clear guidelines to protect your privacy and gives you the right to request that a debt collector stop contacting you.

Recent changes to Regulation F of the FDCPA allow debt collectors to use modern methods of communication, including text messages and emails. While this can be convenient, it also means that consumers need to be aware of their rights. Regulation F sets limits on how and when debt collectors can contact you. They must avoid inconvenient times and places and provide a way for you to opt-out of further communications.

If you’re receiving text messages from a debt collector, you have the absolute right to tell them to stop. Here’s how you can do it simply:

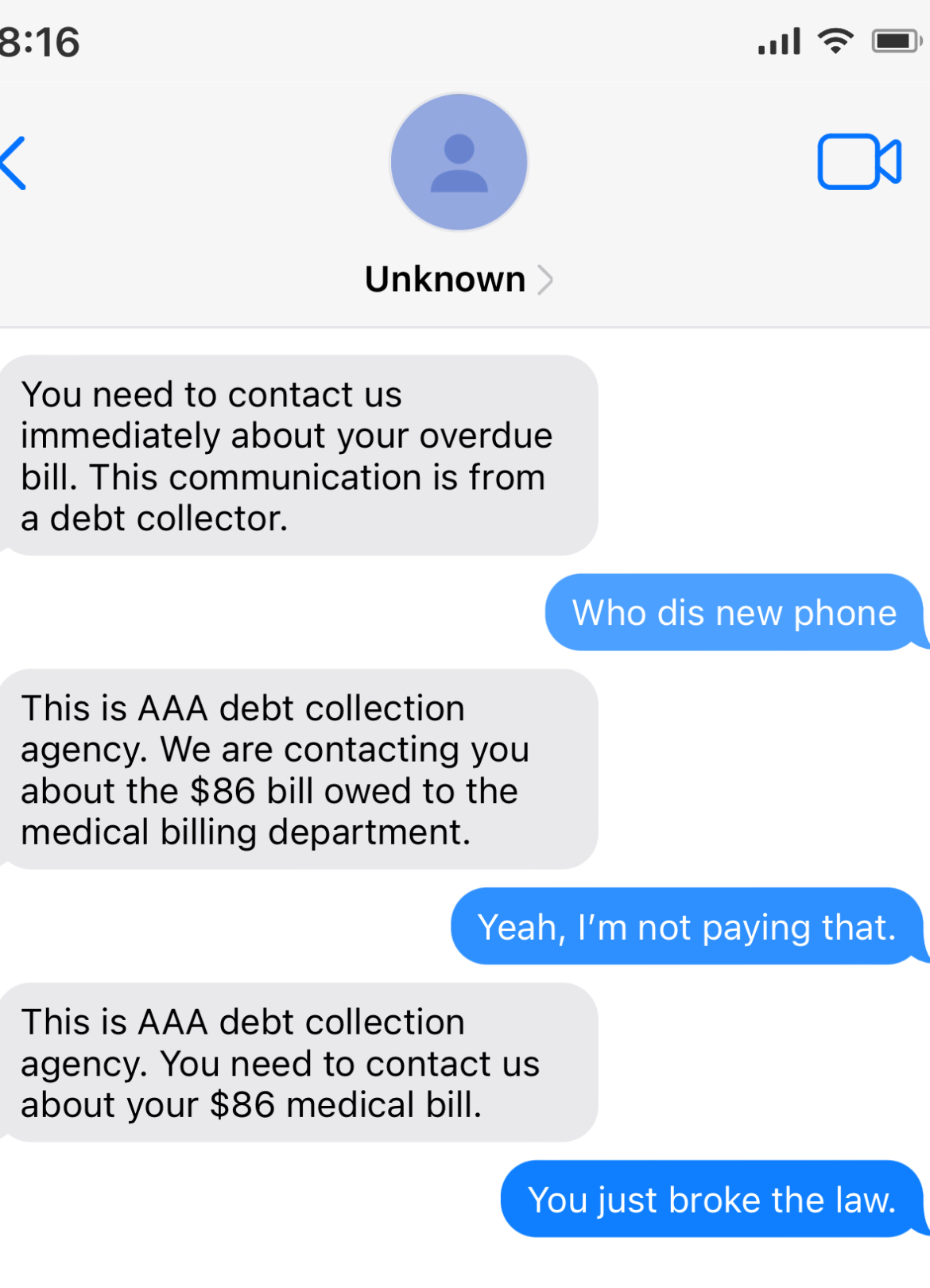

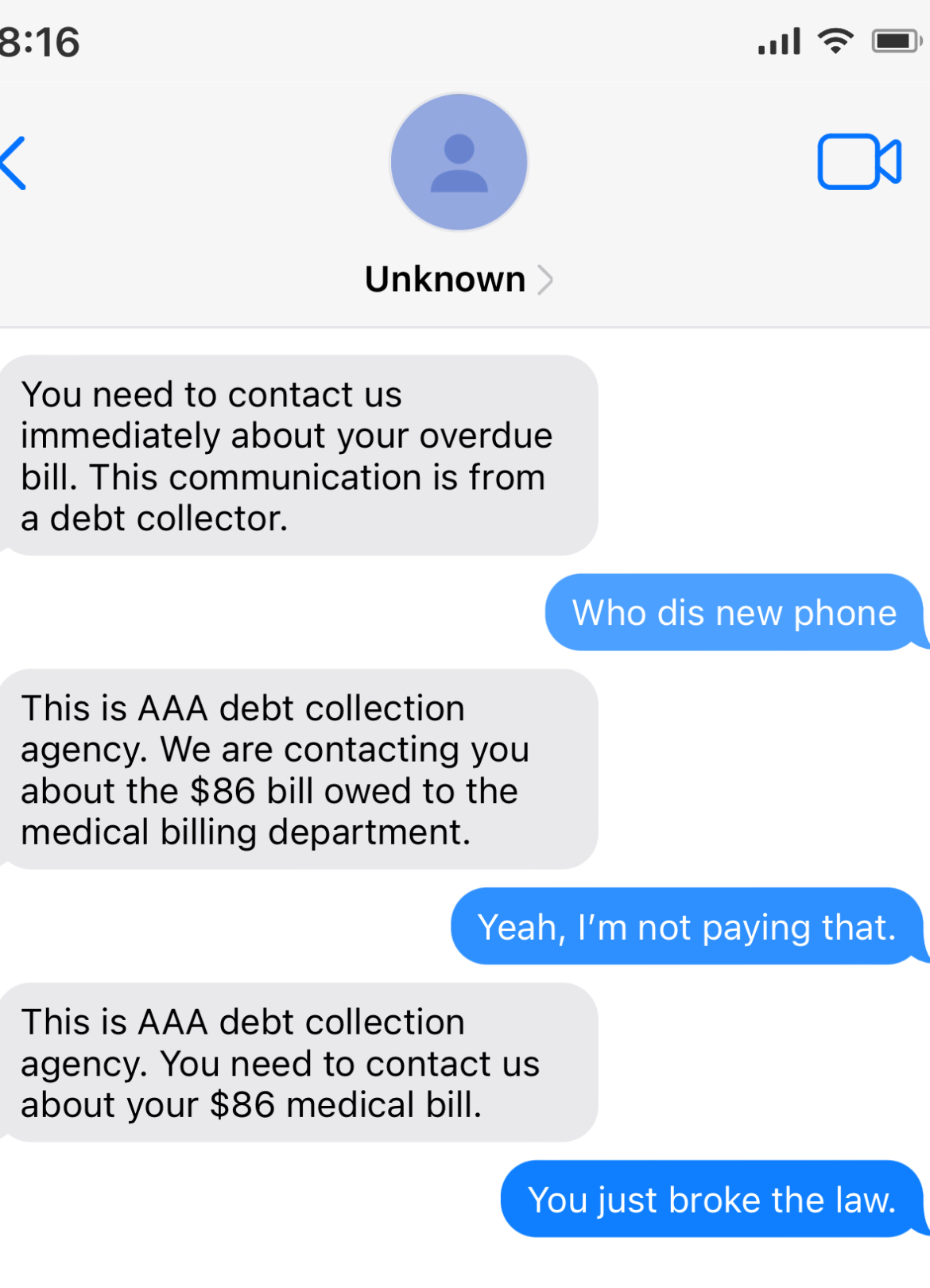

Reply to the Text Message: Send a clear and concise text message back to themstating that you refuse to pay the debt. There are no specific words you must use. Here are some examples of what you could say:

“I’m not paying this.”

“That’s not something I’m going to pay.”

“I’m not paying you.”

“I won’t pay this debt.”

“You won’t get any payment from me.”

“I don’t plan to pay this.”

Keep Records: Save copies of all communications between you and the debt collector. Screenshots showing the date work great. This includes the text messages you receive and the message you send requesting them to stop.

Know the Law: According to the FDCPA, once a debt collector receives your written request, they must stop most forms of collection communication with you immediately. If they continue to text you after receiving your request, they are violating your rights and you should call us.

If a debt collector continues to text you after you’ve asked them to stop, you can enforce your right to privacy through a lawsuit under the FDCPA. The FDCPA allows for the recovery of attorney fees from the debt collector, meaning you can take legal action without worrying about the costs. Our law firm specializes in representing consumers in these cases. We take on these cases without charging our clients anything upfront, only getting paid if we successfully get the collector to compensate you.

It’s crucial to speak with an attorney regarding your potential claims under the FDCPA rather than relying on advice from credit repair gurus. An experienced attorney can provide you with accurate legal advice and confidential representation, ensuring that your rights are fully protected. Credit repair services do not carry the same rights a speaking with an attorneys might not have the necessary legal knowledge to handle your case effectively, and they could end up causing more harm than good.

The FDCPA is designed to help consumers like you. It provides you with the tools you need to stop harassment by debt collectors and to ensure your privacy is respected. By understanding your rights and taking the appropriate steps, you can protect yourself from unwanted and intrusive communications. If you believe a debt collector is violating your rights, don’t hesitate to reach out to our law firm for assistance. We are here to help you navigate the complexities of the FDCPA and to ensure that your privacy is protected.

Dealing with debt collectors can be stressful, but you don’t have to do it alone. The FDCPA provides robust protections for your privacy and gives you the right to stop unwanted text messages from debt collectors. Remember, if a debt collector continues to text you after you’ve asked them to stop, you have legal options available to you. Our firm is committed to helping you enforce your rights and secure the compensation you deserve. Contact us today to learn more about how we can assist you in your fight for privacy and peace of mind.