Paramount Law wins Class Certification against Debt Collector Equinox

FDCPA Class Certification Granted Against Equinox Collection Services

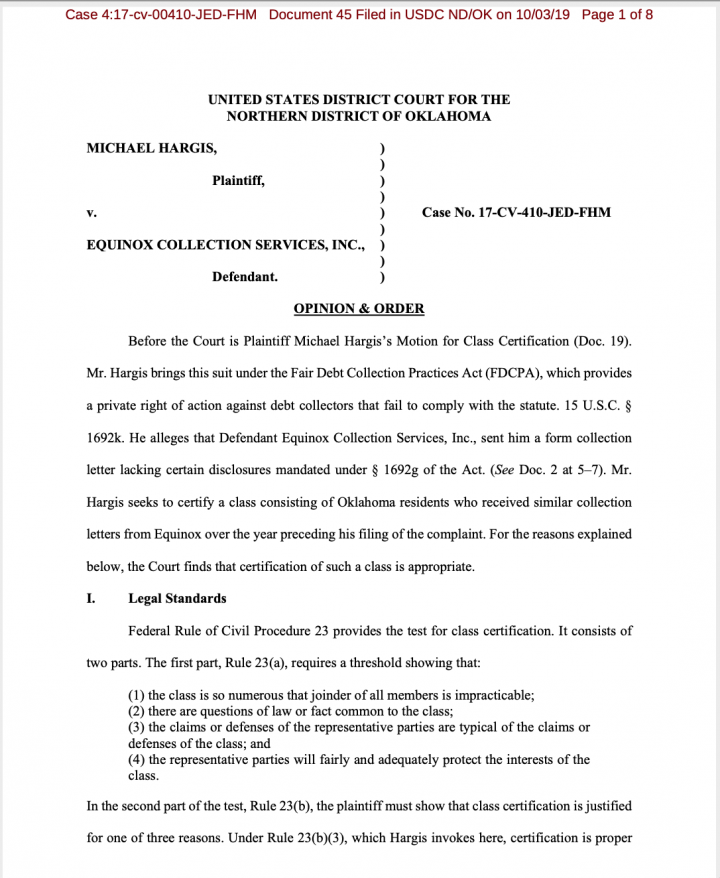

After extensive briefing and oral argument, on October 3, 2019, United States District Court Judge  Dowdell for the Northern District of Oklahoma granted certification of a class of 17,756 Oklahoma residents against a Tulsa debt collector, Equinox Collection Services, Inc. (“Equinox”). In the lawsuit, represented by FDCPA lawyers Victor Wandres and Robert Murphy, the consumer Plaintiff alleged that Equinox failed to provide consumers with the proper disclosures of the rights of consumers to obtain information about debts being collected in violation of the Fair Debt Collection Practices Act (“FDCPA”). The FDCPA was enacted to protect consumers from and to eliminate “abusive debt collection practices by debt collectors.” 15 U.S.C. §1692(e). The FDCPA also protects law abiding debt collectors who refrain from using abusive debt collection practices from being competitively disadvantaged. The FDCPA was enacted by Congress after finding “abundant evidence of the use of abusive, deceptive and unfair debt collection practices by many debt collectors.” 15 U.S.C. §1692(a).

Dowdell for the Northern District of Oklahoma granted certification of a class of 17,756 Oklahoma residents against a Tulsa debt collector, Equinox Collection Services, Inc. (“Equinox”). In the lawsuit, represented by FDCPA lawyers Victor Wandres and Robert Murphy, the consumer Plaintiff alleged that Equinox failed to provide consumers with the proper disclosures of the rights of consumers to obtain information about debts being collected in violation of the Fair Debt Collection Practices Act (“FDCPA”). The FDCPA was enacted to protect consumers from and to eliminate “abusive debt collection practices by debt collectors.” 15 U.S.C. §1692(e). The FDCPA also protects law abiding debt collectors who refrain from using abusive debt collection practices from being competitively disadvantaged. The FDCPA was enacted by Congress after finding “abundant evidence of the use of abusive, deceptive and unfair debt collection practices by many debt collectors.” 15 U.S.C. §1692(a).

A copy of the complete Order Granting Class Certification can be viewed here.

De Minimus Recovery Not a bar to FDCPA Class Certification

The FDCPA limits total damages in a class action to $500,000 or 1 percent of the debt collector’s net worth, whichever is less. 15 U.S.C. § 1692k(a)(2). Equinox argued that class action is not the “superior” vehicle for adjudicating the controversy because a successful class action would likely result in a negligible or de minimus recovery for class members as its “net equity” reached a peak of $434,957 in 2016. However, the Court held that Equinox failed to present competent evidence of such net worth as it only suppled the Court with tax returns for a separate entity — NorthStar Technologies, LLC, and further failed to explain the relationship between Equinox and NorthStar. The Court also expressed frustration in ruling that Equinox did not explain “in the more than fifty pages of tax documents provided, [where] the Court can find something approaching an explanation for the valuation figures [of] the company….”

FDCPA Serves to “Eliminate” Abusive Debt Collection Practices

Additionally, Equinox feigned interest in consumers in arguing that the class-action was not a superior method as an individual consumer could sue and obtain up to $1,000 in statutory damages instead of having to split statutory maximum damage caps in a class action. The Court stated that it was “not persuaded” by Equinox, holding that the one of the purposes of the FDCPA is to “eliminate abusive debt collection practices by debt collectors.” 15 U.S.C. § 1692. Specifically, the Court held:

Equinox’s argument also ignores the punitive purpose of the statutory damages available under the FDCPA. While it is true that class members could probably recover more as individuals, the purpose of the statutory awards is not primarily to compensate victims of deceptive debt collection practices. That concern is provided for by the availability of actual damages. See 15 U.S.C. § 1692k(a)(1). Moreover, the statute explicitly instructs courts to consider a debt collector’s culpability when determining a statutory damages award. § 1692k(b). The statutory damages, therefore, exist in service of the FDCPA’s central purpose: “to eliminate abusive debt collection practices by debt collectors.” 15 U.S.C. § 1692. Thus, although individual class members might be better served by pursuing actions individually, the statute’s purpose is better served by the availability of class action. And the interests of class members are not at odds with class certification. Those who wish to pursue maximum recovery may opt out and bring their own claims. Meanwhile, those who think that $1,000 is not worth the trouble are free to do nothing.

Motion to Dismiss on Spokeo Grounds Previously Denied

Equinox had previously unsuccesfully moved to dismiss the consumer Plaintiff’s case based on a lack of  subject matter jurisdiction. Citing the Supreme Court case Spokeo, Inc. v. Robins, 136 S. Ct. 1540 (2016), Equinox asserted that Plaintiff failed to satisfy the injury-in-fact demands of Article III standing. In a very well-reasoned opinion dated June 3, 2019, the Court found that § 1692g was intended to protect consumers’ concrete interests, and then turned to evaluate whether the specific procedural violations alleged in the case presented a material risk of harm to those concrete interests.

subject matter jurisdiction. Citing the Supreme Court case Spokeo, Inc. v. Robins, 136 S. Ct. 1540 (2016), Equinox asserted that Plaintiff failed to satisfy the injury-in-fact demands of Article III standing. In a very well-reasoned opinion dated June 3, 2019, the Court found that § 1692g was intended to protect consumers’ concrete interests, and then turned to evaluate whether the specific procedural violations alleged in the case presented a material risk of harm to those concrete interests.

The Court held that the consumer Plaintiff need not prove that the alleged violation of § 1692g(a)(2) caused him confusion in order to have standing. Instead, a violation of this particular procedural right “is sufficient in and of itself to constitute concrete injury in fact because Congress conferred the procedural right to protect a plaintiff’s concrete interests and the procedural violation presents a material risk of real harm to that concrete interest.”

The Court held that if Equinox’s collection letter violated § 1692g(a)(3) by failing to provide accurate information concerning how to dispute a debt, that such a violation presents a material risk of harm to the concrete interests Congress intended to protect. The Court reasoned that “a failure to provide accurate information concerning how to dispute a debt entails a significant risk that consumers will forego disputing a debt altogether and lose important consumer protections—even if the debt collector, in practice, handles disputes differently (and more generously) than is suggested by the collection letter itself.”

A copy of the complete Order Denying Equinox Motion to Dismiss can be viewed here.

FDCPA Lawyer Victor R. Wandres was greatly assisted by co-counsel, fellow NACA-member Robert Murphy of The Murphy Law Firm, in representation of the consumer Plaintiff in this matter. Equinox Collection Services is represented by Dennis Barton, a Missouri attorney whose practice also includes consumer debt collection and is a debt collector under the FDPCA. It is hoped that the Equinox class action will provide harmed Oklahomans with a way to stop the unlawful practices alleged in the Complaint.