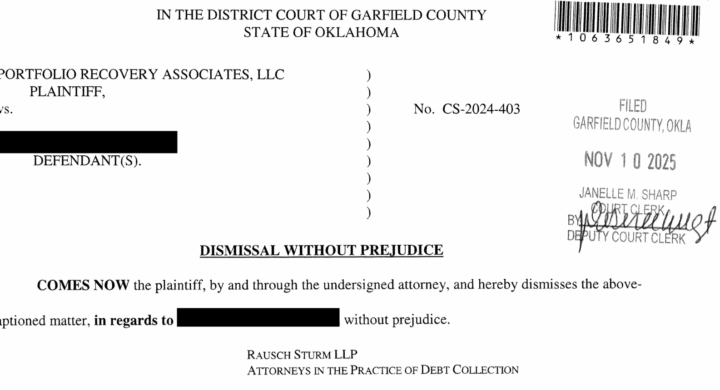

Triple Victory: Portfolio Recovery Associates Dismisses THREE Oklahoma Lawsuits Totaling Over $24,500 in One Day

Some wins take time — and these three were worth every minute.

After more than a year of hard-fought defense in Tulsa County District Court and Garfield County District Court, on November 10, 2025, Portfolio Recovery Associates has voluntarily dismissed all three lawsuits against our clients on the same day. Combined alleged debt: $24,580. Amount our clients paid to PRA: $0.

Three file-stamped dismissals. Three relieved families. Zero judgments, zero garnishments, zero settlements.

The Cases at a Glance

| Case Type | Alleged Amount | Result |

|---|---|---|

| Old credit card debt | $10,859.77 | Dismissed |

| Second credit card account | $8,133.96 | Dismissed |

| Store card turned zombie | $5,587.25 | Dismissed |

| TOTAL | $24,580 | $0 PAID |

Why These Portfolio Recovery Lawsuits Ultimately Failed

Portfolio Recovery Associates (PRA) is one of the most aggressive junk-debt buyers in the country. They purchase ancient, charged-off accounts for pennies on the dollar and file thousands of lawsuits hoping consumers either ignore the summons or can’t fight back effectively.

In these three cases, we refused to let that happen.

Over the course of more than a year, we:

- Challenged chain-of-title defects

- Exposed missing or inadmissible affidavits

- Forced strict compliance with Oklahoma evidence rules and the underlying contract

- Redied aggressive counterclaims for potential violations

Faced with the reality that their evidence wouldn’t hold up and the risk of paying our clients’ attorney fees, Portfolio Recovery did what they eventually do in almost every case we defend — they dismissed all three lawsuits and walked away.

Who Is Portfolio Recovery Associates?

Portfolio Recovery Associates, LLC (NASDAQ: PRAA), one of the largest junk-debt buyers in the world, continues to acquire massive volumes of charged-off consumer accounts at a fraction of face value. According to the company’s most recent filings and earnings reports (Q3 2025), PRA is currently paying an average purchase price multiple of approximately 2.14x in the Americas — which, based on their historical recovery curves and industry benchmarks, translates to roughly 4–8 cents on the dollar of original face value, depending on the age and type of debt. In plain English: for every $24,562 they sued our three Tulsa clients for, similar portfolios were purchased by PRA for somewhere between $982 and $1,965 total. When those cases are defended aggressively, the math stops working — which is exactly why they dismissed all three the moment we proved their evidence wouldn’t hold up in court.

The Bottom Line for Oklahoma Consumers

These three dismissals prove once again: Portfolio Recovery Associates lawsuits are beatable — even the ones that drag on for months .

If you’ve been sued by Portfolio Recovery Associates in Tulsa County, Oklahoma County, or anywhere in the state, don’t assume you have to pay just because they filed a lawsuit. Most of these cases have fatal flaws — you just need someone willing to find them and fight.

Ready to Fight Back Against Portfolio Recovery?

Call the day you’re served. We handle these cases on a flat-fee basis so you know exactly what it costs — no surprises, no hourly bills.

📞 (918) 200-9272 Free consultation. Real results.

Disclaimer: Past results do not guarantee future outcomes. Each case is unique and depends on individual facts and circumstances. This post is for informational purposes only and does not constitute legal advice.